- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

It’s time to adjust the way you think about your relationship with your bank. We all know the standard banking products, like checking accounts, personal loans, and mortgages. But some banks offer more resources, tools, and products than you may realize.

Let’s look at some of the banking products you may not be using but should be. These are just a few of our favorite lesser-known tools and services at First Financial Bank to help you make your financial life easier to manage than you ever thought was possible.

A lot of us start our banking journey with a checking account, usually when we get our first job, and stick with that type of account for our money throughout our lives. Checking accounts are great for day-to-day purchases and paying bills, but what if you have other needs with your money? Here are two of our favorite accounts to consider now and in the future:

In addition to earning interest on your money, savings accounts offer an additional layer of protection from fraudsters since you don’t typically have a debit card used for daily purchases directly tied to your account. They also make it easy to manage your money and reach savings goals. When you separate your savings from your day to day checking account, it’ll be far less tempting to spend the money on impulse purchases. You can even have multiple savings accounts that you can name to further organize your money based on your savings goals, like a vacation fund and a home downpayment.

Bank accounts aren’t just for adults. Does your youngster have an entrepreneurial spirit? Whether they are shoveling snow, mowing lawns, or running a lemonade stand, the best place for their cash isn’t a piggy bank. Most banks offer accounts tailored to kids and students. For example, at First Financial, kid accounts are designed to grow with them. As your youngster becomes a teenager and gets their first job and paycheck direct deposited, the account will evolve, and we’ll add access to a debit card and ATMs.

Aside from the convenience of an account that grows to meet your child’s needs as they get older, allowing your kids to see their money grow in their account teaches valuable financial skills. You also can teach the basics of budgeting when they want to spend their money on new toys and technology.

Online banking options are as common as banks themselves these days, but let’s look at some things you can do using technology beyond just checking your balances and moving money around.

Money management tools are a powerful way to optimize your finances. You can use them to track where your money is going, set financial goals, layout a budget and even link other financial institutions so everything is in one place.

Some banks offer tools like this as part of their online banking options and app, which makes it even easier to keep track of your entire financial life. You can use money management tools to get a big picture view of your finances, while still having the option to look at smaller components of your financial life. If you’d like to learn more about our money management tool, Insights, you can get the details here.

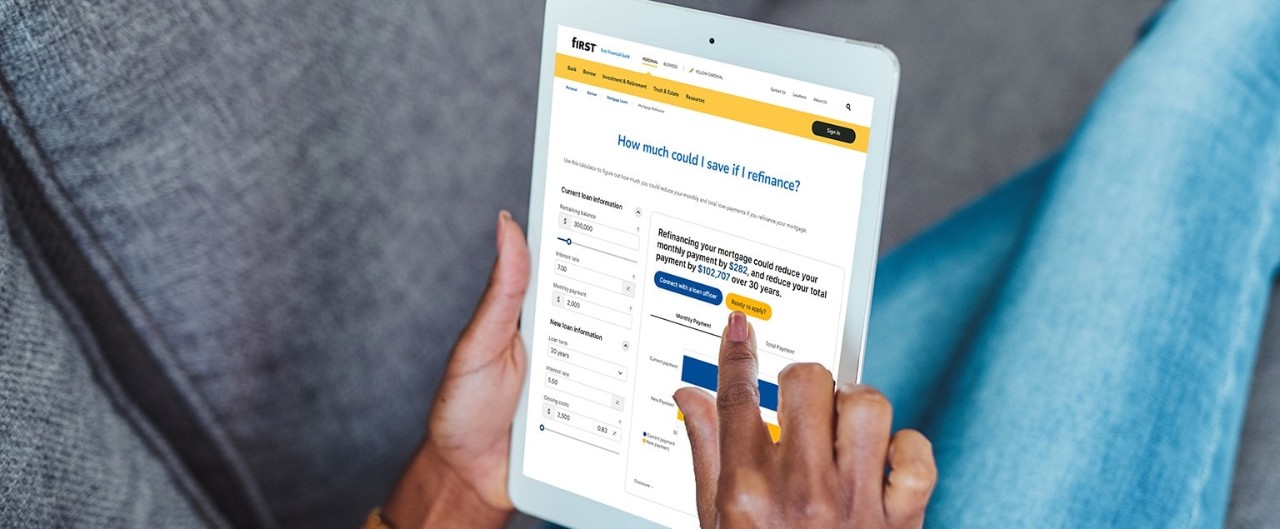

Do you have questions about how much your monthly payment would be for personal or car loan or if you’re considering a mortgage, how much home you can afford? Online calculators are a great way to start your research. If you are considering buying a home, calculators can help you get a feel for how much home you can afford and what your monthly payments would be including additional costs like home insurance and taxes you may not have factored in to the payment.

You can use calculators to find ways to enhance your savings too! When shopping for higher interest rates for your savings you can use a calculator to compare different interest rate options and time frames to see how much your money will grow over time.

Online calculators can even help you wrap your mind around your monthly budget. Simplifying the budgeting process makes you far more likely to stick with it and calculators can take most (or even all) of the math out of the equation.

Financial education and literacy skills don’t require advanced financial concepts or high-level math. It is more about building muscle through practice and repetition. You don’t need a huge paycheck to take control of your financial life either. Self-guided classes and blogs are a great way to learn the things they don’t teach in school when it comes to your personal finances.

Financial education is a key part of your financial journey, so some banks (like us) offer classes to help you learn about a variety of topics like debt management, buying a home, and protecting your identity.

If video presentations or online classes aren’t your thing, there’s also plenty of educational articles out there about every financial topic under the sun. These blogs are a great way to answer questions you have about your finances from a trusted source, without needing to call or talk in person.

We get it, going into the bank isn’t always at the top of everyone’s to-do list. But making the trip has more benefits than you realize. Human interaction leads to a wide array of benefits, including more customized solutions for your financial needs.

Sometimes there’s just no substitute for going into a bank in person and meeting face-to-face with a trusted professional. You’ll get personalized attention tailored to your unique goals, like buying a home or getting the best rates you can on your savings. You may even learn about some products and tools you didn’t know existed before. Your local banker will get to know you and over time can provide you with the best tools and products for your financial goals.

Selling your car? Updating your will or Power of Attorney? Representing yourself in a real estate transaction? You’ll need a notary. Not sure where to find a notary? Most banks offer this service free of charge when you’re a client. Like us, we have them at select banking centers. To find a Frist Financial Bank location with notary services near you just click here and select filters and check the box for notaries.

We want to let you in on a little secret… some banks offer reduced rates on loans to their customers that use them as their primary bank including us. The best part? The lesser-known lending benefits don’t stop there.

Having a true partnership with your bank can lead to big time savings. Having multiple accounts at one bank, using your debit card frequently, or maintaining certain balances can also lead to reduced or eliminated fees and even big-time reductions in loan interest rates that can save you money over time.

One of the best ways to take full advantage of relationship pricing is to consolidate your bank accounts into one institution. Want to learn more about these benefits? We have you covered.

Buying a home? You should consider getting prequalified. Getting pre-qualified is an easy, online process that allows you to wrap your mind around your budget, monthly payment and what expectations you should have surrounding the homebuying process. Prequalifying also lets you know where you stand when it comes to getting approved for a loan, without hurting your credit score in the process. Getting prequalified also gives you a leg up when you make an offer since the seller knows you’ve already done your due diligence about getting approved for a loan.

While there’s no substitute for an emergency fund, we know sometimes life throws unexpected expenses your way. If you find yourself in a bind, some banks offer fast approvals on short-term loans, at far better interest rates than payday lenders.1

At First Financial, a personal loan like the f1RST® Quick Loan provides short-term funds without the need for collateral and even offers the option of interest-only payments for the first six months to help you get back ahead thanks to lower initial repayments.

Maybe you are a bit further along in your financial journey and are looking for something more. Did you know many banks offer enhanced wealth management options to help maximize your financial situation, plan for retirement, and handle the creation of important documents for trusts and estates?

Many banks can support people with more complex financial sitations than average day-to-day needs through their wealth management products and tools. For example, Yellow Cardinal, our premier wealth management and advisory brand can help you handle everything from financial planning, investment management, to retirement plans and private banking. There are even options to help business owners manage things like business succession planning, mergers and acquisitions, and employee retirement plans.2

Trust and estate services allow you to preserve your financial legacy while taking the emotional and legal strain off your family's plate during the process of settling your estate. It is important to plan ahead, and a trusted team makes it easy to ensure a smooth transfer of assets and protection for your beneficiaries and loved ones.

Banks are more than the place you go to withdraw money from an ATM or drop off some extra cash you had on hand to save. They offer products, services, and a personal touch that goes far beyond a checking account and online banking. This guide covered a few of our favorite lesser-known bank offerings, but the list is much longer than just this article. You never know if the perfect solution to your financial needs is out there, sometimes all you need to do is ask!

Are you a small business owner? All these tips apply to your business too. Our experienced business finance teams have the knowledge and experience to guide you through your needs, so you can focus on your business strategy faster, and go further. You can start a conversation with a banker near you today.

1 APR = Annual Percentage Rate. All loans are subject to credit review and approval and rates are subject to change without notice. A First Financial Bank deposit account is required for approval. Minimum 660 credit score required.

Online First Quick Loan applications must be requested in amounts between $2,000 and $50,000. Applications above $50,000 must be made in a branch and require additional information and documentation. The loan will have a draw period with a promotional rate for the first six months. After 6 months any outstanding balance will convert to a 60-month term loan which will require principal and interest payments. Some loans may be eligible for additional relationship-based account benefits. For information on loan benefits, please view our please view our checking account options.

2 Yellow Cardinal Advisory Group, a division of First Financial Bank, provides investment advisory, wealth management, and fiduciary services. Yellow Cardinal Advisory Group does not provide legal, tax, or accounting advice. The products and services made available by Yellow Cardinal Advisory Group are: not deposits, not insured by FDIC or any government agency, not guaranteed by the financial institution, subject to risk, and may lose value.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

Businesses that are new to First Financial Bank on or after February 23, 2026 can access their day-to-day account activity here.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.