- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

Our current economy has many wondering whether there is a way to grow wealth.

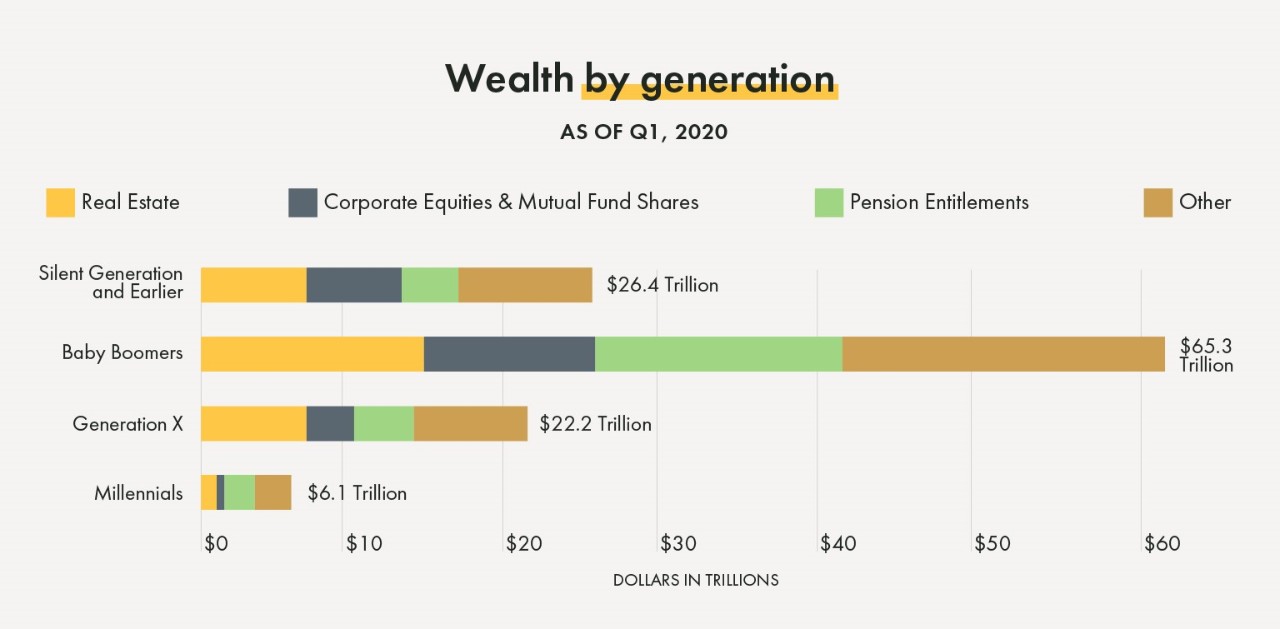

Baby Boomers hold the bulk of wealth as demonstrated in the chart below. That said, there's still opportunity, and the old adage still rings true, “Opportunity favors those who prepare themselves."

What can you do to prepare yourself for growing wealth? Here are six on-the-money tips for growing wealth:

Would you drive across the country without a navigational plan (or, at the very least, a map)? Of course, you shouldn't plan your financial future without a financial road map.

Without a plan, how can you achieve your financial goals? You can't. You need something to work towards.

Since your overall goal is to grow wealth, you need to start planning and setting smaller goals that help you achieve your primary goal. For instance, you can utilize the power of compounding returns on your interest that builds over time to grow wealth to use during retirement.

Basically, you'll be earning "interest on interest" when future interest calculations carry on the original principal and any already-accrued interest.

Growing wealth requires controlling your money, and that requires a budget. It's the only way to stay on track financially. Setting and sticking to a budget will show you how you spend your money, where you can reduce spending, and plan for growing wealth.

Emergencies can happen at any moment, and if you are not well-prepared, they can devastate you financially. Not only do you want to ensure that your insurance plans cover you in case of natural or unforeseen disasters, but you should also have money available to use when these emergencies occur.

Retiring with debt over your head will not help you grow your wealth. Once you have established financial goals, a budget, and your emergency fund, it is time to evaluate what you currently owe and how you can pay that debt off.

Set up a plan that will allow you to pay this debt off over time. Review long-term obligations (like vehicles, homes, or other properties) for better rates and pay off any short-term debts. Take care of any delinquencies or overdue accounts.

Contact the credit bureaus for a copy of your credit report, even if you think you may know what is on it. Verify that all items on your credit reports are correct, and file claims against fraudulent accounts.

Earning more money is the best approach for growing wealth. You can save or invest any money you earn beyond living expenses.

Your wealth can grow exponentially over time. You can do this with a combination of investing, patience, and a long-term timeline. (Although, it's never too late to set up a financial plan to save.)

Some can feel overwhelmed when they think about investing because they think it's too complex to navigate. Yet, learning the basics is easier than you think.

Many assume you have to have wealth to invest. That isn't true, either. Here are some ways you can begin your investment planning today:

Additionally, remember that buying rental properties or investing in land are also investments. You can also grow equity in your home by upgrading or remodeling.

Growing wealth requires conversations with financial professionals to help you understand the best path to fit your specific needs and lifestyle. You can discuss the advantages and drawbacks of certain stocks, CDs, savings accounts, mutual funds, IRAs, and other investment options.

Your financial advisor will work with you regarding diversifying your accounts to ensure that you build a broad foundation for your financial goals. That way, if an unforeseen event adversely impacts your portfolio, only one area takes the hit, allowing you and your advisor to work on a strategy to manage these ebbs and flows.

Looking for more tips on how to grow wealth? Contact us today to speak to one of our knowledgeable professionals.

Generational Wealth graphic: Adapted from “Generational Wealth Inequality,” by Ben Carlson, A Wealth of Common Sense; https://awealthofcommonsense.com/2020/07/generational-wealth-inequality/

Side Hustle Statistics graphic: Adapted from “Side Hustle Survey 2019: Who Has One and How Much Do They Make?,” by Jen Smith, Dollar Sprout; https://dollarsprout.com/side-hustle-statistics/

The information on this page is accurate as of October 2022 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page.

The information provided herein is for illustrative purposes and should not be considered investment advice and is not designed to address your investment objectives, financial situation or particular needs. The information is as of the date referenced herein and is subject to change at any time based on market, economic or other conditions. The data represented has been obtained from sources deemed reliable, but we do not guarantee its accuracy or completeness.

You cannot directly invest in an index. Indexes are unmanaged and measure the changes in market conditions based on the average performance of the securities that make up the index. Investing in small and mid-cap stocks generally involves greater risks, and therefore, may not be appropriate for every investor. Asset allocation and diversification does not ensure a profit or protect against a loss.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.

Businesses that are new to First Financial Bank on or after February 23, 2026 can access their day-to-day account activity here.

If you are still unsure, please contact the Business Support Center at 866.604.7946.

You are encouraged to bookmark the platform page once you have successfully accessed your account.